- Article

- Long-Term Financing

- Additional Funding

Commercial Cards for optimised working capital

"Managing working capital has always been at the top of a corporate treasurer’s priorities, and during a period of economic uncertainty maintaining cash levels is even more demanding", says Lewis Sun, Regional Head of Product, Asia Pacific at HSBC. He explains how HSBC’s Commercial Cards provide a flexible cash flow solution for your business needs.

Cash is the fuel that keeps a company going. A steady flow of working capital is essential to meet the commitments that a business faces – a list that includes paying salaries, servicing loans, and remunerating suppliers.

Ensuring the company has sufficient access to cash is a vital function for corporate treasurers. It is a responsibility that becomes significantly harder during periods of economic uncertainty – such as the COVID-19 pandemic that has disrupted the global economy in 2020.

In this series of three articles, we discuss how treasurers can take advantage of Commercial Cards to realise company-wide benefits in a number of important areas – including procurement, data visibility, and digitalisation. In this first article, we consider the range of cash flow challenges companies face, and how a Commercial Card’s interest free credit can help free up day-to-day cash.

The Cash Flow Challenge

Overcoming all of these pain points is a day-to-day struggle for a corporate treasurer. But in an unpredictable business environment, maintaining adequate levels of cash becomes a strategic asset that is prioritised across the company.

Doing business in a globalised economy allows companies to explore opportunities in a wide range of countries. But at the same time, a treasurer has to manage payments along increasingly complicated supply chains, with each stage potentially tying up working capital.

The inability to quickly pay a supplier at one stage of the supply chain has knock on effects further down the chain - from production all the way to delivery. Additionally, if a company has lengthy internal payment protocols that leave suppliers waiting to get paid, it jeopardises efforts to negotiate better terms with its vendors.

The more complex and geographically spread out a company’s operations are, the less visibility a treasurer typically has on the entire accounts payable and receivable process. If a company does not have a clear view on its outstanding payments, it will not always know when it should apply for short-term credit to cover the cost of daily operations.

Another major financial challenge that companies face relates to day-to-day expenses – such as employee spend on travel, training, IT, office equipment, as well as entertaining customers. Processing so many relatively small payments is costly as treasurers are under pressure to make the process as swift and cost-effective as possible. A strong cash position helps the company meet these commitments in an efficient manner.

Overcoming all of these pain points is a day-to-day struggle for a corporate treasurer. But in an unpredictable business environment, maintaining adequate levels of cash becomes a strategic asset that is prioritised across the company. The COVID-19 pandemic highlights many of the risks that arise when the global economy is suddenly disrupted – broken supply chains, delayed payments from customers, and reduced access to credit.

The Commercial Card Solution

Commercial Cards are a lending facility that offer a simple way to immediately optimize working capital.

Commercial Cards help resolve these pain points. It redefines how you manage your payments across the full spectrum of expense categories - from business travel and entertainment, to supplier invoices, and general operational costs, all while freeing up cash within the organisation.

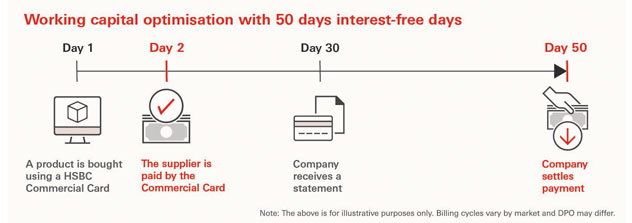

The most immediate working capital benefit of a Commercial Card is access to 51 days of interest free credit*, which offers greater flexibility for the company to manage their liabilities in a way that is both convenient and cost effective. It is a lending facility that offers a simple way to immediately optimise an organisation’s cash position.

The other main benefit comes from efficiency gains, as Commercial Cards are an automated payment channel that requires minimal manual processing. In this respect, cards compare favourably with traditional payments that include paper invoices, which are slower and more costly to complete due to the additional steps in the process. An automated payment solution reduces both processing charges and labour costs due to reduced time spent on the processing. These savings free up cash, adding to a company’s reserves of working capital.

Both benefits are evident when paying for your business’s digital advertising. Not only is online advertising a major marketing channel for companies across a wide range of industries, but major digital platforms accept cards as a form of payment.

When a company uses a Commercial Card to pay for an advertisement, the payment is settled in just two days. And with 51 days of interest free credit*, the company has nearly two months before it needs to settle the payment. The cash that would have otherwise been tied up in a traditional payment is now working capital that can be used to support other areas of the business.

The working capital gains are also compounded by automation, as straightforward digital processing contributes to cost savings with a reduction in manual invoice processing and payments.

These benefits can be realised in any purchasing category where suppliers take card payments. The result is that HSBC’s Commercial Cards are an easy and immediate solution that can help treasurers manage and optimise cash, with a positive impact that can be felt across the company. They can help improve cash yields and provide convenient financing.

To find out more about how HSBC’s Commercial Cards can help optimise your company’s working capital, please contact your relationship manager. In the next article in this series, we go into greater detail on how Commercial Cards can simplify the procurement process.

*Days Payable Outstanding (DPO) extension of up to 51 days interest free. The number of interest-free days is dependent on the agreed billing cycle. Utilization of the card facility is subject to the terms and conditions which govern that facility and HSBC’s credit and risk policies.