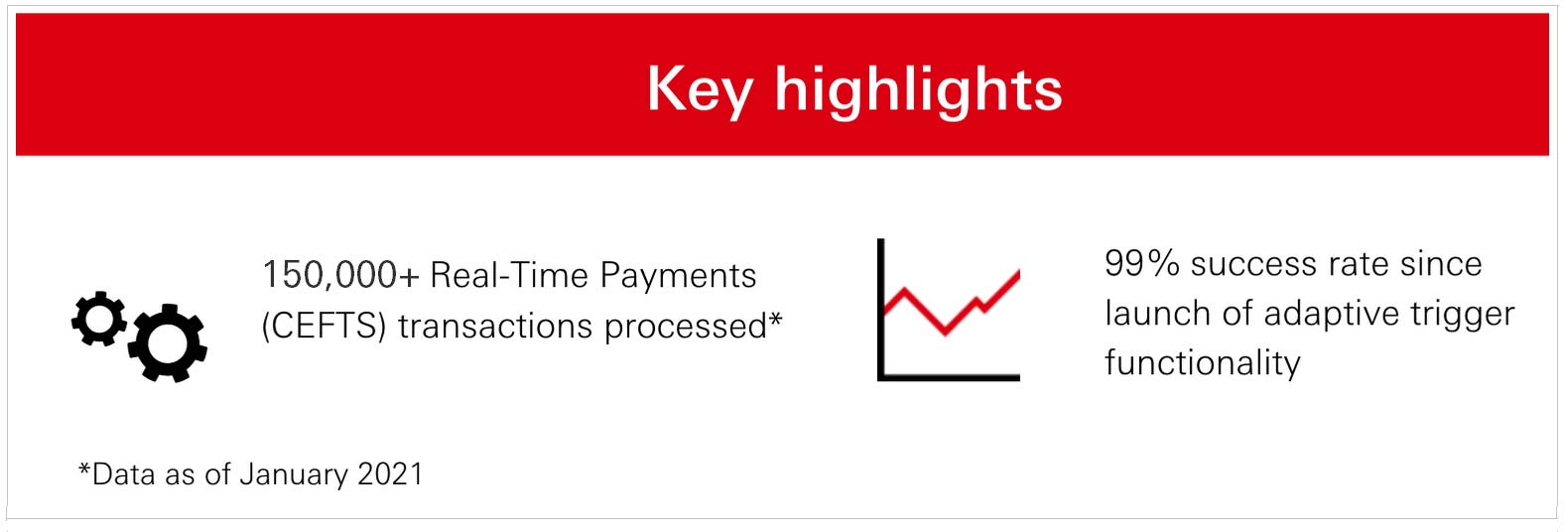

Frequent payment rejection can be frustrating for drivers, customers, and the transportation company. That's why we are driving a smarter settlement process for our client using Common Electronic Fund Transfer Switch in Sri Lanka, and using adaptive triggers to increase the payment success rate to 99%. Drivers and riders are now able to enjoy a seamless payment process, and a smoother journey.

Client case

Back to Building Smarter BusinessAccelerating the payment success rate of ride-hailing to 99% with one simple solution

Our client is a large scale company offering services that include ride hailing and food delivery, with a comparatively small operations team. Its platforms can be accessed via its website and mobile app, connecting riders with nearby screened drivers who provide rides in private vehicles.

Background & Scope

The company offers ride-sharing and food delivery services in Sri Lanka. Through its website and mobile application, passengers and customers are connected to drivers and restaurants based on location and need. Customers pay using debit cards, credit cards, or eWallets as soon as orders are placed. Drivers for both the ride sharing and food delivery are paid one week later using Automated Clearinghouse (ACH) payments to their local bank accounts.

With local competition on the rise, our client needed to dissuade drivers from switching to competitors. They were seeking a smooth payment channel for payments to be settled in real-time, while also providing the company with adequate levels of detail to support its reconciliation process.

Challenges

- Frequent recurrence of rejected payments – Commonly caused by incorrect bank account details or system timeouts with local banks, resulting in late payments to drivers

- Inability to automate payment status, reconcile paid drivers and a lack of visibility over the reasons for payment return on rejected payments - This meant a lot of time spent on reconciling rejections in order to initiate another payment attempt to drivers

- Driver retention was at risk – Slower payment settlement caused discontent with drivers, who could switch to driving for competitors at any time

Automated payment solution with enhanced acknowledgement details and minimal rejection

Leveraging Sri Lanka’s real-time payment network Common Electronic Fund Transfer Switch (CEFTS), HSBC enhanced and enriched the instant acknowledgement reports to include payment reference IDs and specific reasons for rejection. This gave the company added visibility over rejected payments which it lacked previously.

Most drivers hold accounts with local banks, which caused some system errors and network issues. As an added mechanism to reduce the recurrence of rejected payments, HSBC also created an automated solution that ensures multiple attempts are made at planned intervals, ultimately leading to more successful payments and a smoother settlement process.

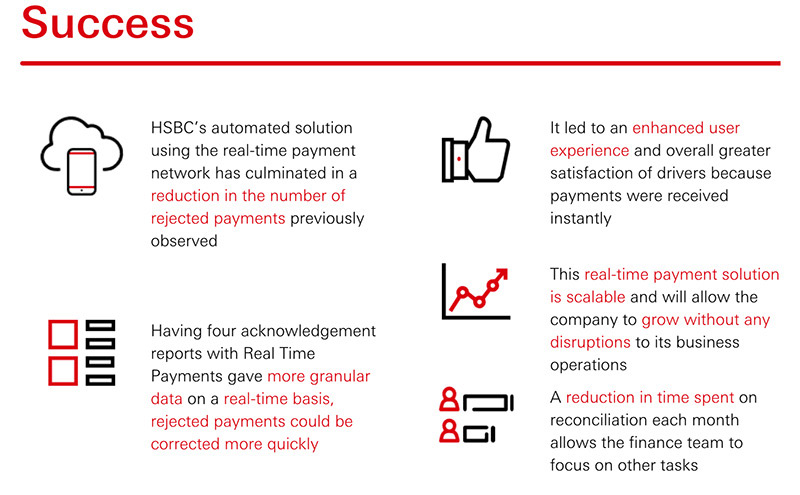

- HSBC’s automated solution using the real-time payment network has meant the success rate of transactions increased from 83% to 99%

- It led to an enhanced user experience and overall greater satisfaction of drivers because payments were received instantly

- Having four acknowledgement reports with Real Time Payments gave more granular data on a real-time basis, rejected payments could be corrected more quickly

- This real-time payment solution is scalable and will allow the company to grow without any disruptions to its business operations

- Drivers are now able to request funds on-demand 24*7 compared to previously weekly payment schedules